Payroll reports

Expense distribution report

The payroll expense distribution report displays detailed payroll information for all employees processed through payroll. This report can be used to reconcile payroll salary and benefit charges to your department. Reports are emailed twice a month.

Salary and benefits commitments

Salary and benefits for regular faculty and staff will be encumbered/committed in department cost centers. This includes salary, retirement, insurance, social security and Medicare. This feature will allow departments to more accurately project the available balance in their cost centers.

How it works

Each pay period, new encumbrances will be calculated and posted in SAP cost centers based on the employee wage and benefit data stored in the SAP system.

Departments must notify the appropriate hiring office of any changes to an employee's position or status. If they fail to do this in a timely manner the encumbrances/commitments will not reflect the appropriate amount. For example, if an employee leaves the university but the department does not inform the hiring office, then the employee will still be in active status and an encumbrance will still be calculated and posted for that employee.

Note that an amount for social security tax will still be encumbered even after an employee reaches their maximum social security tax liability for the calendar year. This issue will correct itself with the first encumbrance run in January of each year.

Where to find encumbrances

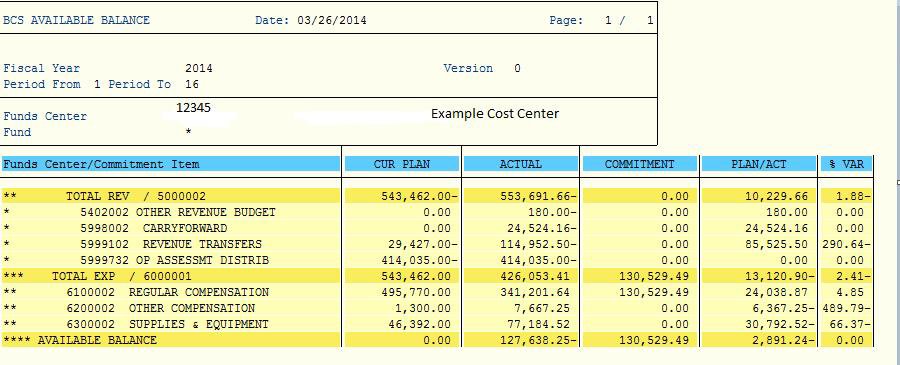

In SAP you will find the encumbrances under Funds Management Reports-BCS Available Balance (see example cost center report).

If you are in need of a commitment/encumbrance file, please call 989-774-3481 or email payroll@cmich.edu.

Frequently asked questions about salary commitments

What is an encumbrance/commitment?

An encumbrance is a transaction that sets aside a portion of a budget because you've made a commitment to pay for something.

Why are salaries encumbered?

Encumbrances are a planning tool. Only known, on-going wages/salaries are encumbered because that is what's necessary to calculate your available budget balance. It's unnecessary to encumber one-time payments because they are usually paid right away.

Why aren't ALL salaries encumbered?

Student, temp and Global Campus faculty wages are not encumbered because they are not on a set wage or salary. It is usually not known what they will be paid over a period of time. Departments will have to continue to manually deduct what they plan on paying these employees.

Will the initial encumbrances posted on 7/1 be for the whole fiscal year?

Yes, the encumbrances posted on July 1 will include any salary that has been entered in SAP for the fiscal year. Remember that 10-month faculty salaries may not have been entered yet. They will be included when they are entered into SAP.

When will the 10-month faculty salaries be encumbered?

These are usually entered during the summer and posted prior to the start of the fall semester. Temporary faculty on a 10-month contract are entered when the paperwork is received by Faculty Personnel Services.

How often will the encumbrances be run or adjusted?

The encumbrance program is run after each semi-monthly and each bi-weekly payroll. It will adjust the encumbrances to make them equal to whatever "commitments" have been made in SAP for the current fiscal year. In other words any salary adjustments (increases in pay, etc.) set up in SAP will be included.

Will higher class pay or lump sums be encumbered?

If higher-class pay is set up as an ongoing payment such as when an employee is filling in for another employee on an indefinite basis then it will be encumbered. If it is for a one-time purpose then it will not be encumbered. One-time lump sum payments will not be encumbered.

We often pay faculty on an overload. Will these be encumbered and if so, how?

The encumbrance will be calculated and displayed according to the time frames and cost centers entered in SAP. If you see an encumbrance listed under your cost center that should be somewhere else you need to contact us (or the respective employment office) right away. This probably means the expense is not being charged correctly.

Part of my salary is charged back to a grant. Where will this encumbrance be posted?

If the salary is split in SAP, then the encumbrance for the salary will be split between the cost centers too.

Who should I call if I have questions about an encumbrance?

Please call the payroll office at 989-774-3481 if you have any questions about encumbrances/commitments.