Financial Wellness Collaborative

The Financial Wellness Collaborative aims to inspire confidence in students' financial decision-making and ensure students build the knowledge and skills necessary to ensure life-long financial wellness.

We know there are a lot of costs to attending college beyond tuition, such as housing, basic food and hygiene needs, textbooks, transportation and more. Additionally, the financial aid process is detailed and complicated, especially student loans. The Financial Wellness Collaborative is here to demystify the finances of the college experience and students build the skills necessary for life-long financial success.

On-demand financial education

CMU is excited to offer students iGrad, the premier financial education resource for college students. Through this web-based platform, students can explore hundreds of up-to-date financial wellness topics at their own pace. iGrad offers interactive, accurate, and concise financial education where and when students need it. Take advantage of this resource today!

Peer coaching

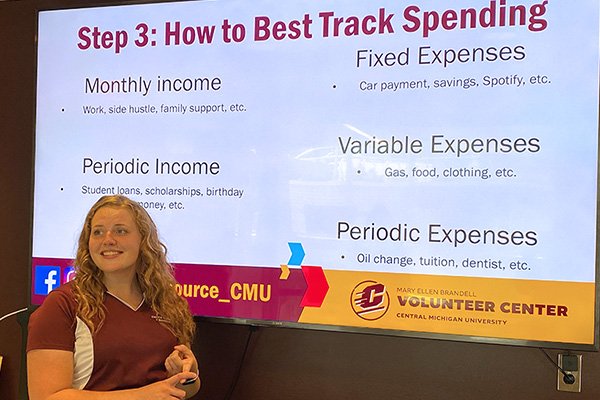

The Financial Wellness Collaborative Peer Coaches are available to meet one-on-one with students to create plans for their personal financial situations. Peer Coaches can assist students in creating budgets, savings plans, educating about credit, and more!

Request a presentation

The Financial Wellness Collaborative’s Peer Coaches are available to present to students, faculty

Please provide at least 14 days between your presentation request and your desired presentation date.

Four-year plan for financial wellbeing at CMU

Developing the broad range of financial knowledge and skills to prepare for a lifetime of financial wellness takes time. We break down the basics of financial wellness and encourage students to attend two sessions each year to ensure they are prepared for each next step in their college and career journey. In addition to attending these programs, we encourage students to schedule an annual Financial Wellness Checkup with a Peer Coach. Programs range from 30 minutes to 1 hour.

Develop the knowledge and skills you need for life-long financial success with our four-year plan.

Year 1

- Financial Wellness 101

- Understanding Student Loans

In these sessions, students will learn the basics components of financial wellness and funding their college education.

Year 2

- Basics of Budgeting

- All Things Credit

In year 2, students learn the basics of budgeting and building credit. These sessions are particularly helpful for students considering moving off-campus.

Year 3

- Savings Accounts and Emergency Plans

- The cost of the job search and grad school hunt

Year 3 prepares students to take the next step in their career journey and to begin making plans for life post-college.

Year 4

- Evaluating Job Offers

- Health insurance and Retirement Accounts

Year 4 programming helps students understand and evaluate those all-important job offers so they can make informed career choices for their future.

In addition to these programs, the Financial Wellness Collaborative offers a wide array of programming and presentations to help students learn about important financial considerations such as preparing to move into a first apartment, getting the most out of your involvement dollar, and more!